Loss of patents ate up a chunk of Pfizer (PFE)'s profits as evidenced by recently released figures. Earnings reports, recently released, disappointed investors with its bleak outlook as its first quarter profit dropped 15% despite many implementations to reduce expenses. The company's revenue, too, declined by 9%, especially after the loss of its patent drugs, which once earned a massive profit of billions. Cholesterol inhibitor Lipitor, which alone earned nearly $13 billion, suffered an astounding 71% dip.

The Current Picture

CEO Ian Read has restructured the business into three different segments. New drugs, generic and already established medicines make up the first two while the third consists of a mix of vaccines, cancer drugs and consumer health products. Among these three, established products took the biggest blow with a 10% fall in revenue, while the new- drug segment fell only by 4%. The third segment showed mixed results with oncology medicine revenue growing by 10% while consumer products fell by 3%.

The pharma giant had expected an impressive top-line from its newer products such as Eliquis and Lyrica, but huge losses incurred by losing out the exclusivity of its best-selling drugs could not be made up by the newer products. The company's net income was 2.33 billion, or 36 cents per share early this year, down from 2.75 billion, or 38 per cent comparison in last year.

Future Prediction

Despite a sharp decline in first quarter revenue, the company is hopeful about the future of its bottom line. Although Pfizer lost the patent to its most profitable drug, the company still foresees a favorable outcome, in the coming months. In fact, the profit fell at a slower rate than its revenue, dropping by 5% to $0.36 per share, which may create a better feeling to its investors.

CEO Ian Read claimed that the pipeline is brimming with products which could possibly revolutionize the market in near future. He also confirmed that company's profit for earnings per share would be around 2.20 to 2.30 while the revenue expected to be $49.2 billion to 52.3 billion. The company is expecting to recover the loss from the sale of its, as yet experimental, drug Palbociclib. Expected future growth in sales of its pneumonia vaccine Prevner 13 has, too, been deemed to be helpful.

But the main hope, as we all know, is pinned on the deal with British company Astrazeneca Plc (AZN).

About The AstraZeneca Deal

Even after being refused three times, Pfizer is still enthusiastic about the deal with British rival AstraZeneca. Despite repeated rebuffs, the U.S. company is relentless in its pursuit of AstraZeneca and has repeatedly asked to discuss the purchasing bid.

Acquiring AstraZeneca has a lot of potential benefits for Pfizer. For one, this merger would make Pfizer the largest pharmaceutical company in terms of revenue gain. With the announcement of the recent three way deal between GlaxoSmithKline (GSK), Novartis (NVS) and Eli Lilly (LLY), Pfizer Inc desperately needs something to keep investors interested – and for the right reasons.

AstraZeneca also boasts of several drugs in the pipeline that could vitalize Pfizer's profile, the most interesting being the experimental cancer drug that could facilitate the body's immune system to detect and destroy cancerous cells. The acquisition further comes with the benefit of lower tax rates for the pharma giant. By merging with its British rival, Pfizer would be able to shift its legal addresses to UK thus circumventing higher US tax deductions.

But of course, all this happens only when the deal goes through, if it goes through at all.

So What Does It All Mean?

Pfizer, as a company, is failing and officials know that. They have several ideas and forecasts, but it is just that – a probably future. For the second time last week, AstraZeneca rejected Pfizer's bid, this time a whopping $106 billion. Sources say that the British corporation is unwilling to even enter negotiations. To put it in a nutshell, AstraZeneca is just not interested.

In the meantime Pfizer's shares keep on dropping. Since the start of May, the stock has fallen by over 6%. Moreover, in the last 12 months, the stock has only gained 3.5%, one of the worst performances from any major drug maker enlisted in the S&P 500.

Parting Thoughts

The losses incurred by the company are not made up easily. The failed expectancies, loss of patents as well as the botched deal all point to a bleak future. However the time to despair hasn't, as yet, arrived.

One of the leading names in pharmaceutical products, Pfizer is not one to bow down easily. The drug maker is trying out new avenues to pick up its pace. While these will take time, we are hopeful the strategy will bear fut. It is true that the company is balanced at a precarious edge, but we are confident it won't topple just yet. We just have to wait till it finds its footing.

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) | |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

PFE STOCK PRICE CHART

29.03 (1y: -1%) $(function(){var seriesOptions=[],yAxisOptions=[],name='PFE',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1368421200000,29.37],[1368507600000,29.4],[1368594000000,29.56],[1368680400000,29.25],[1368766800000,28.96],[1369026000000,28.7],[1369112400000,28.78],[1369198800000,29.3],[1369285200000,29.11],[1369371600000,29.04],[1369717200000,29.01],[1369803600000,28.28],[1369890000000,28.25],[1369976400000,27.23],[1370235600000,27.75],[1370322000000,27.66],[1370408400000,27.48],[1370494800000,28.11],[1370581200000,28.26],[1370840400000,28.37],[1370926800000,28.42],[1371013200000,28.43],[1371099600000,29.08],[1371186000000,29.09],[1371445200000,29.16],[1371531600000,29.4],[1371618000000,29.1],[1371704400000,28.635],[1371790800000,28.46],[1372050000000,27.71],[1372136400000,27.99],[1372222800000,28.1],[1372309200000,28.18],[1372395600000,28.01],[1372654800000,27.78],[1372741200000,27.7],[1372827600000,27.65],[1373000400000,27.97],[1373259600000,28.13],[1373346000000,28.35],[1373432400000,28.44],[1373518800000,28.77],[1373605200000,28.81],[1373864400000,28.79],[1373950800000,28.68],[1374037200000,28.68],[1374123600000,28.49],[1374210000000,29.09],[1374469200000,29.35],[1374555600000,29.42],[1374642000000,29.28],[1374728400000,29.19],[1374814800000,29.37],[1375074000000,29.54],[1375160400000,29.67],[1375246800000,29.23],[1375333200000,29.11],[1375419600000,29.37],[1375678800000,29.19],[1375765200000,29.34],[1375851600000,29.26],[1375938000000,29.13],[1376024400000,29.21],[1376283600000,29.19],[1376370000000,29.27],[1376456400000,29.03],[1376542800000,28.8],[1376629200000,28.37],[1376888400000,28.46],[1376974800000,28.53],[1377061200000,28.24],[1377147600000,28.16],[1377234000000,28.34],[1377493200000,28.02],[1377579600000,27.995],[1377666000000,28.21],[1377752400000,28.1],[1377838800000,28.21],[1378184400000,28.01],[1378270800000,28.37],[1378357200000,28.27],[1378443600000,28.28],[1378702800000,28.3],[1378789200000,28.45],[1378875600000,28.67],[1378962000000,28.31],[1379048400000,28.51],[13! 79307600000,28.71],[1379394000000,28.64],[1379480400000,29.04],[1379566800000,28.84],[1379653200000,28.97],[1379912400000,28.8],[1379998800000,28.71],[1380085200000,28.49],[1380171600000,28.52],[1380258000000,28.88],[1380517200000,28.725],[1380603600000,28.89],[1380690000000,29.01],[1380776400000,28.77],[1380862800000,29],[1381122000000,28.62],[1381208400000,28.24],[1381294800000,28.29],[1381381200000,28.77],[138146

) for $6.4 billion.

) for $6.4 billion.

[ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] Justin Sullivan/Getty Images DETROIT -- Federal food safety officials say ground beef recalled by a Detroit business may have been sent to stores in 10 states. According to an announcement Thursday, the U.S. agriculture department's Food Safety and Inspection Service says it has reason to believe recalled beef was sent to retail outlets in Florida, Illinois, Indiana, Kentucky, Michigan, North Dakota, Ohio, Pennsylvania, Tennessee and Wisconsin. Wolverine Packing Co. announced Monday it was recalling 1.8 million pounds of ground beef products that may be contaminated with E. coli. FSIS had said 11 people were sickened. Messages seeking an updated figure were left Friday. Consumers can see a list of recalled products on the U.S. Department of Agriculture's website. Here is a state-by-state list of retail outlets that the U.S. Agriculture Department's Food Safety and Inspection Service says may have received ground beef involved in the recall:

Justin Sullivan/Getty Images DETROIT -- Federal food safety officials say ground beef recalled by a Detroit business may have been sent to stores in 10 states. According to an announcement Thursday, the U.S. agriculture department's Food Safety and Inspection Service says it has reason to believe recalled beef was sent to retail outlets in Florida, Illinois, Indiana, Kentucky, Michigan, North Dakota, Ohio, Pennsylvania, Tennessee and Wisconsin. Wolverine Packing Co. announced Monday it was recalling 1.8 million pounds of ground beef products that may be contaminated with E. coli. FSIS had said 11 people were sickened. Messages seeking an updated figure were left Friday. Consumers can see a list of recalled products on the U.S. Department of Agriculture's website. Here is a state-by-state list of retail outlets that the U.S. Agriculture Department's Food Safety and Inspection Service says may have received ground beef involved in the recall:

Popular Posts: The Best Ways to Buy the Alibaba IPO5 Ways Apple Is Trying to Pump Value Into AAPL Stock5 Top Fidelity Mutual Funds to Own Recent Posts: 7 Reasons to Believe in JCP Stock Again Could Yahoo Become the Next Berkshire Hathaway? 5 Ways Apple Is Trying to Pump Value Into AAPL Stock View All Posts

Popular Posts: The Best Ways to Buy the Alibaba IPO5 Ways Apple Is Trying to Pump Value Into AAPL Stock5 Top Fidelity Mutual Funds to Own Recent Posts: 7 Reasons to Believe in JCP Stock Again Could Yahoo Become the Next Berkshire Hathaway? 5 Ways Apple Is Trying to Pump Value Into AAPL Stock View All Posts  In his words, Mike Ullman is "trying to get JCP back to being a mediocre department store that's kind of dying very slowly instead of very fast." That can't be good for JCP stock.

In his words, Mike Ullman is "trying to get JCP back to being a mediocre department store that's kind of dying very slowly instead of very fast." That can't be good for JCP stock.

T-Mobile CEO's world with no contracts

T-Mobile CEO's world with no contracts

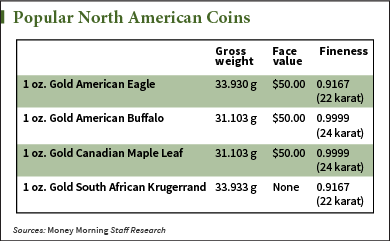

For North Americans, the four coins at left are among the most popular. Although they all contain 1 full troy ounce of gold, some also contain other metals, like copper, which makes the coin harder and therefore less subject to wear and tear.

For North Americans, the four coins at left are among the most popular. Although they all contain 1 full troy ounce of gold, some also contain other metals, like copper, which makes the coin harder and therefore less subject to wear and tear. Related FOSL Will Fossil Inc. (FOSL) Beat Earnings Estimates? - Analyst Blog UPDATE: Benchmark Upgrades Fossil Related RAX Rackspace Shares Rally 12+% Following Q1 Earnings Beat, Solid Guidance Earnings Scheduled For May 12, 2014

Related FOSL Will Fossil Inc. (FOSL) Beat Earnings Estimates? - Analyst Blog UPDATE: Benchmark Upgrades Fossil Related RAX Rackspace Shares Rally 12+% Following Q1 Earnings Beat, Solid Guidance Earnings Scheduled For May 12, 2014

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  29.03 (1y: -1%) $(function(){var seriesOptions=[],yAxisOptions=[],name='PFE',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1368421200000,29.37],[1368507600000,29.4],[1368594000000,29.56],[1368680400000,29.25],[1368766800000,28.96],[1369026000000,28.7],[1369112400000,28.78],[1369198800000,29.3],[1369285200000,29.11],[1369371600000,29.04],[1369717200000,29.01],[1369803600000,28.28],[1369890000000,28.25],[1369976400000,27.23],[1370235600000,27.75],[1370322000000,27.66],[1370408400000,27.48],[1370494800000,28.11],[1370581200000,28.26],[1370840400000,28.37],[1370926800000,28.42],[1371013200000,28.43],[1371099600000,29.08],[1371186000000,29.09],[1371445200000,29.16],[1371531600000,29.4],[1371618000000,29.1],[1371704400000,28.635],[1371790800000,28.46],[1372050000000,27.71],[1372136400000,27.99],[1372222800000,28.1],[1372309200000,28.18],[1372395600000,28.01],[1372654800000,27.78],[1372741200000,27.7],[1372827600000,27.65],[1373000400000,27.97],[1373259600000,28.13],[1373346000000,28.35],[1373432400000,28.44],[1373518800000,28.77],[1373605200000,28.81],[1373864400000,28.79],[1373950800000,28.68],[1374037200000,28.68],[1374123600000,28.49],[1374210000000,29.09],[1374469200000,29.35],[1374555600000,29.42],[1374642000000,29.28],[1374728400000,29.19],[1374814800000,29.37],[1375074000000,29.54],[1375160400000,29.67],[1375246800000,29.23],[1375333200000,29.11],[1375419600000,29.37],[1375678800000,29.19],[1375765200000,29.34],[1375851600000,29.26],[1375938000000,29.13],[1376024400000,29.21],[1376283600000,29.19],[1376370000000,29.27],[1376456400000,29.03],[1376542800000,28.8],[1376629200000,28.37],[1376888400000,28.46],[1376974800000,28.53],[1377061200000,28.24],[1377147600000,28.16],[1377234000000,28.34],[1377493200000,28.02],[1377579600000,27.995],[1377666000000,28.21],[1377752400000,28.1],[1377838800000,28.21],[1378184400000,28.01],[1378270800000,28.37],[1378357200000,28.27],[1378443600000,28.28],[1378702800000,28.3],[1378789200000,28.45],[1378875600000,28.67],[1378962000000,28.31],[1379048400000,28.51],[13! 79307600000,28.71],[1379394000000,28.64],[1379480400000,29.04],[1379566800000,28.84],[1379653200000,28.97],[1379912400000,28.8],[1379998800000,28.71],[1380085200000,28.49],[1380171600000,28.52],[1380258000000,28.88],[1380517200000,28.725],[1380603600000,28.89],[1380690000000,29.01],[1380776400000,28.77],[1380862800000,29],[1381122000000,28.62],[1381208400000,28.24],[1381294800000,28.29],[1381381200000,28.77],[138146

29.03 (1y: -1%) $(function(){var seriesOptions=[],yAxisOptions=[],name='PFE',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1368421200000,29.37],[1368507600000,29.4],[1368594000000,29.56],[1368680400000,29.25],[1368766800000,28.96],[1369026000000,28.7],[1369112400000,28.78],[1369198800000,29.3],[1369285200000,29.11],[1369371600000,29.04],[1369717200000,29.01],[1369803600000,28.28],[1369890000000,28.25],[1369976400000,27.23],[1370235600000,27.75],[1370322000000,27.66],[1370408400000,27.48],[1370494800000,28.11],[1370581200000,28.26],[1370840400000,28.37],[1370926800000,28.42],[1371013200000,28.43],[1371099600000,29.08],[1371186000000,29.09],[1371445200000,29.16],[1371531600000,29.4],[1371618000000,29.1],[1371704400000,28.635],[1371790800000,28.46],[1372050000000,27.71],[1372136400000,27.99],[1372222800000,28.1],[1372309200000,28.18],[1372395600000,28.01],[1372654800000,27.78],[1372741200000,27.7],[1372827600000,27.65],[1373000400000,27.97],[1373259600000,28.13],[1373346000000,28.35],[1373432400000,28.44],[1373518800000,28.77],[1373605200000,28.81],[1373864400000,28.79],[1373950800000,28.68],[1374037200000,28.68],[1374123600000,28.49],[1374210000000,29.09],[1374469200000,29.35],[1374555600000,29.42],[1374642000000,29.28],[1374728400000,29.19],[1374814800000,29.37],[1375074000000,29.54],[1375160400000,29.67],[1375246800000,29.23],[1375333200000,29.11],[1375419600000,29.37],[1375678800000,29.19],[1375765200000,29.34],[1375851600000,29.26],[1375938000000,29.13],[1376024400000,29.21],[1376283600000,29.19],[1376370000000,29.27],[1376456400000,29.03],[1376542800000,28.8],[1376629200000,28.37],[1376888400000,28.46],[1376974800000,28.53],[1377061200000,28.24],[1377147600000,28.16],[1377234000000,28.34],[1377493200000,28.02],[1377579600000,27.995],[1377666000000,28.21],[1377752400000,28.1],[1377838800000,28.21],[1378184400000,28.01],[1378270800000,28.37],[1378357200000,28.27],[1378443600000,28.28],[1378702800000,28.3],[1378789200000,28.45],[1378875600000,28.67],[1378962000000,28.31],[1379048400000,28.51],[13! 79307600000,28.71],[1379394000000,28.64],[1379480400000,29.04],[1379566800000,28.84],[1379653200000,28.97],[1379912400000,28.8],[1379998800000,28.71],[1380085200000,28.49],[1380171600000,28.52],[1380258000000,28.88],[1380517200000,28.725],[1380603600000,28.89],[1380690000000,29.01],[1380776400000,28.77],[1380862800000,29],[1381122000000,28.62],[1381208400000,28.24],[1381294800000,28.29],[1381381200000,28.77],[138146

Popular Posts: 7 Biotechnology Stocks to Buy Now10 Best “Strong Buy” Stocks — DAL ILMN TPL and more13 “Triple A” Stocks to Buy Recent Posts: Biggest Movers in Utilities Stocks Now – OGS CPL ELP NRG Hottest Healthcare Stocks Now – WCG PCRX ARNA THC Biggest Movers in Technology Stocks Now – IDTI AVGO ALU CODE View All Posts

Popular Posts: 7 Biotechnology Stocks to Buy Now10 Best “Strong Buy” Stocks — DAL ILMN TPL and more13 “Triple A” Stocks to Buy Recent Posts: Biggest Movers in Utilities Stocks Now – OGS CPL ELP NRG Hottest Healthcare Stocks Now – WCG PCRX ARNA THC Biggest Movers in Technology Stocks Now – IDTI AVGO ALU CODE View All Posts