Back in 2017, Spark Therapeutics (NASDAQ:ONCE) won the first FDA-approval for voretigene neparvovec-rzyl (Luxturna) - a one-time gene therapy for patients afflicted with biallelic RPE65 mutation-associated retinal dystrophy. The historic milestone foretold an incoming wave of stellar development fostered by the lower regulatory hurdles.

Riding on the wave of gene-based therapeutic innovation is Adverum Biotechnologies (NASDAQ:ADVM). The company is nourishing a promising in-house portfolio that already secured two strong partnerships that we��ll discuss later. As reflective of its increasing intrinsic value, the shares traded significantly northbound for the past 52 weeks. In specific, the stock gained $3.05 to exchange hands at $6.15 for over 103% profits. In this research, we��ll elucidate the underlying fundamentals of Adverum while focusing on the upcoming catalytic developments.

Figure 1: Adverum stock chart. (Source: StockCharts)

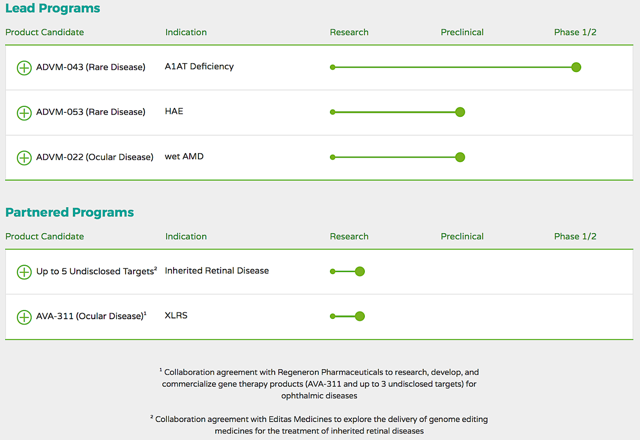

Fundamental AnalysisHeadquartered in Menlo Park CA, Adverum is focused on the innovation and commercialization of gene therapy to service serious rare and eye diseases with unmet needs. As featured in figure 2, the company is powering an enriched pipeline of molecules to potentially treat the orphan conditions - alpha-1 antitrypsin (��A1AT��) deficiency and hereditary angioedema (��HAE��) - as well as wet age-related macular degeneration (wAMD).

Figure 2: Therapeutic pipeline (Source: Adverum)

We elucidated that gene-based therapy is one of the next waves of innovations that is delivering hopes for countless patients worldwide. Moreover, it is rewarding early supporters with substantial wealth. Like all novel molecules, there are certain therapeutic limitations. Be that as it may, these setbacks can be overcome. One of which is the durability of responses. Accordingly, the next-generation adeno-associated virus (��AAV��) is a highly prudent vector for gene transfer to deliver more ��sustained�� gene expression.

For a small company innovating the breakthrough of our lifetime, the availability of resources can be another limiting factor. A strategy to circumvent this potential issue is to form prudent partnerships. This is exactly what Adverum had done. The company secured the collaborative deal with Regeneron Pharmaceuticals (NASDAQ:REGN) to research, develop, and commercialize gene therapy products for ophthalmic diseases.

A partnership was also formed with Editas Medicine (NASDAQ:EDIT) to explore the delivery of genome editing medicines for the treatment of inherited retinal conditions. That aside, the core capabilities of Adverum include clinical development and in-house manufacturing expertise, specifically in process and assay development.

Despite several interesting catalysts, we are most interested in the recent announcement of the long-term preclinical data re the efficacy and safety of ADVM-022 as a gene therapy for wAMD. After the 13th month, the single intravitreal injection of the said molecule demonstrated statistical significance in the efficacy and tolerability that are similar to aflibercept (Eylea), the powerful blockbuster of Regeneron.

As follows, the data will be presented tomorrow (on May 17) at the 21 Annual Meeting of the American Society of Gene & Cell Therapy (ASGCT). If the future trial results can demonstrate strong outcomes, it��s not far from the truth that the company can be acquired by Regeneron to complement its eye diseases portfolio.

Additionally, we��re most intrigued by the upcoming results of ADVM-043 for A1AT deficiency. Adversum will present the preliminary data from the Phase 1/2 (ADVANCE) clinical trial in H2 2018. And, the outcome of this upcoming catalyst can have major ramifications to the investment thesis. Commenting on the latest development, the interim President and CEO (Leone Patterson) enthused:

Our plans and timelines for our three lead gene therapy programs remain on track and we have the resources to execute. At ASGCT next week, we look forward to presenting long-term preclinical efficacy data on ADVM-022 in wet AMD. For ADVANCE, our Phase 1/2 clinical trial of ADVM-043 in alpha-1 antitrypsin deficiency, we plan to report preliminary data in H2 2018. Also in H2 2018, we plan to submit two investigational new drug (��IND��) applications to the FDA, for ADVM-022 in wet AMD and ADVM-053 in hereditary angioedema, as we prepare to advance these two additional gene therapies into the clinic. For Q1 2018 (ended on March 31), Adverum reported the $0.2M net revenues compared to $0.5M for the same period the year prior. The research and development (R&D) expenses for the said period came in at $12.8M, a $3.7M increase from the $9.1M for the similar quarter. The higher R&D is expected, as the company further advanced the phase 1/2 trials for ADVM-022 and -053. Moreover, there were $17.2M ($0.30 per share) net losses compared to the $16.1M ($0.38 per share) declines for the respective comparisons. Investors should be cognizant that it is the norm for a relatively young bioscience like Adverum to incur significant losses for many years prior to banking a net profit (due to the lengthy and low success rate of the innovation process). Nonetheless, it only takes one blockbuster to make your investment worthwhile.

In viewing the balance sheet, there were $247M in cash and marketable securities, thereby representing a 30% improvement from the $190.5M back in Q4 2017. The strengthened cash position came from the $64.5M raised from the public offering back in Feb. Based on the metrics, the company should have adequate cash to fund operations into the end of 2019 (prior to any additional financing).

Final RemarksIn harnessing the power of the AAV delivery vehicle, Adverum is nurturing a strong pipeline of gene therapy. The most immediate catalyst - the reporting of the ADVANCE trial - can significantly increase the company��s prospects. In the longer horizon, if the results for the wAMD can deliver strong outcomes, it��ll position the company to be acquired by Regeneron. Risk-wise, the main concern for Adverum (at this point in its growth cycle) is if ADVM-043 can deliver positive data for the ADVANCE trial (to be reported in H2).

Pending on the outcomes, we expect the stock to move by roughly 50%. Moreover, even if the aforesaid medicine will be approved, it might not generate substantial sales due to market competition and other unforeseen variables. Furthermore, the other risk is that the company is relatively young. And, its leadership is still in the transition phase. Last but not least, we recommend investors to check out other gene-based therapeutic innovators featured in our Specialty Report.

Author��s Notes: We��re honored that you took the time to read our market intelligence. Founded by Dr. Hung Tran, MD, MS, CNPR, (in collaborations with Analyst Vu, and other PhDs), Integrated BioSci Investing (��IBI��) is delivering stellar returns. To name a few, Nektar, Spectrum, Atara, and Kite procured over 335%, 151%, 260%, and 83% profits, respectively. Our secret sauce is extreme due diligence with expert data analysis. The service features a once-weekly exclusive Alpha-Intelligence article, daily analysis/consulting, and model portfolios. Of note, there is an IBI version of this article that is a higher-level intelligence with extensive details, in which we published in advanced and exclusively for our subscribers. And, we invite you to subscribe to our marketplace now to lock in the current price and save money for the future.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I like to inform our readers of Seeking Alpha's recent policy change, in which the company implemented the paywall (not only to my articles but to all articles that are published over 10-day). This is in place, as the company is, after all, a business. And, the revenues from ads are not adequate to support the high-quality research that the company is providing. If you are a REAL TIME FOLLOWER, you will be notified immediately of our new research for you to continue to benefit from our due diligence. You can also gain access to all of my old articles and much more by taking the 2-week FREE trial of my marketplace, Integrated BioSci Investing.

No comments:

Post a Comment